– Company exceeds all guidance metrics

– Fourth quarter total SaaS clients increased 13% and SaaS monthly active users increased 37% year-over-year

DALLAS, February 23, 2023 – Thryv Holdings, Inc. (NASDAQ:THRY) (“Thryv” or the “Company”), the provider of the leading small business software platform, Thryv®, announced that it grew its SaaS revenue 25% year-over-year in the fourth quarter of 2022.

“We delivered strong fourth quarter results, closing out a record year at Thryv,” said Joe Walsh, Thryv Chairman and CEO. “We exceeded all of our guidance metrics – reporting strong SaaS revenue growth, improving SaaS Adjusted EBITDA and increasing marketing services revenue. Our key SaaS metrics, subscribers and ARPU, grew double digits year-over-year as a result of our focus on innovation and execution. Our software platform is driving time to first value for clients. We hear from clients they want to reduce friction by consolidating their multiple point solutions and logins. With our do-it-all cloud based platform, SMBs have one login and one dashboard to gain greater business efficiency.”

“As we begin 2023, we are focused on our strategic initiatives – increasing engagement and usage – because these lead to increased renewal and spend,” Walsh continued. “In support of our goal of driving engagement, we recently announced the move to a multiple-center platform. By offering multiple centers, we can solve additional problems small to medium businesses (SMBs) face.”

Marketing Center, Thryv’s newest center, delivers the tools an SMB needs to market and grow their business. The solution offers improved online presence, a suite of marketing tools, search, social, display and connected TV advertising. In the future, additional centers will be launching enabling SMBs to address additional problems.

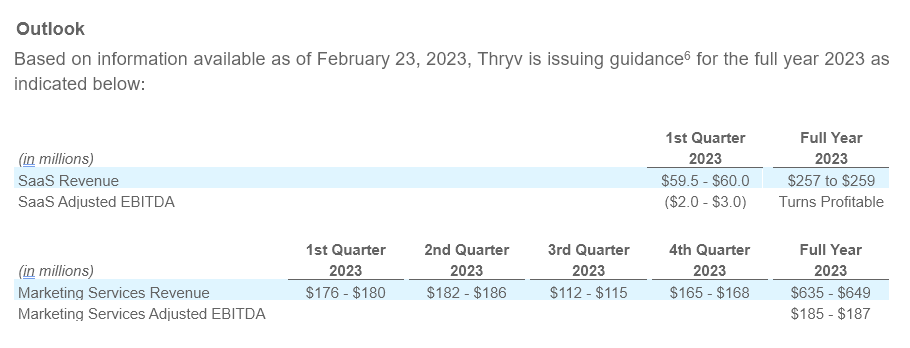

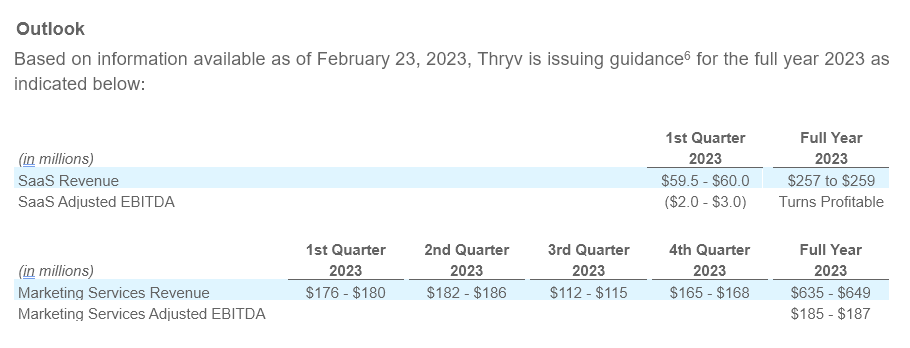

“I am confident that in 2023, we will sustain durable SaaS revenue growth and will continue to generate strong EBITDA margins from a consolidated standpoint,” said Paul Rouse, Chief Financial Officer. “Given the strength of our product offering, size of our customer base and revenue diversification, market demand has remained strong.”

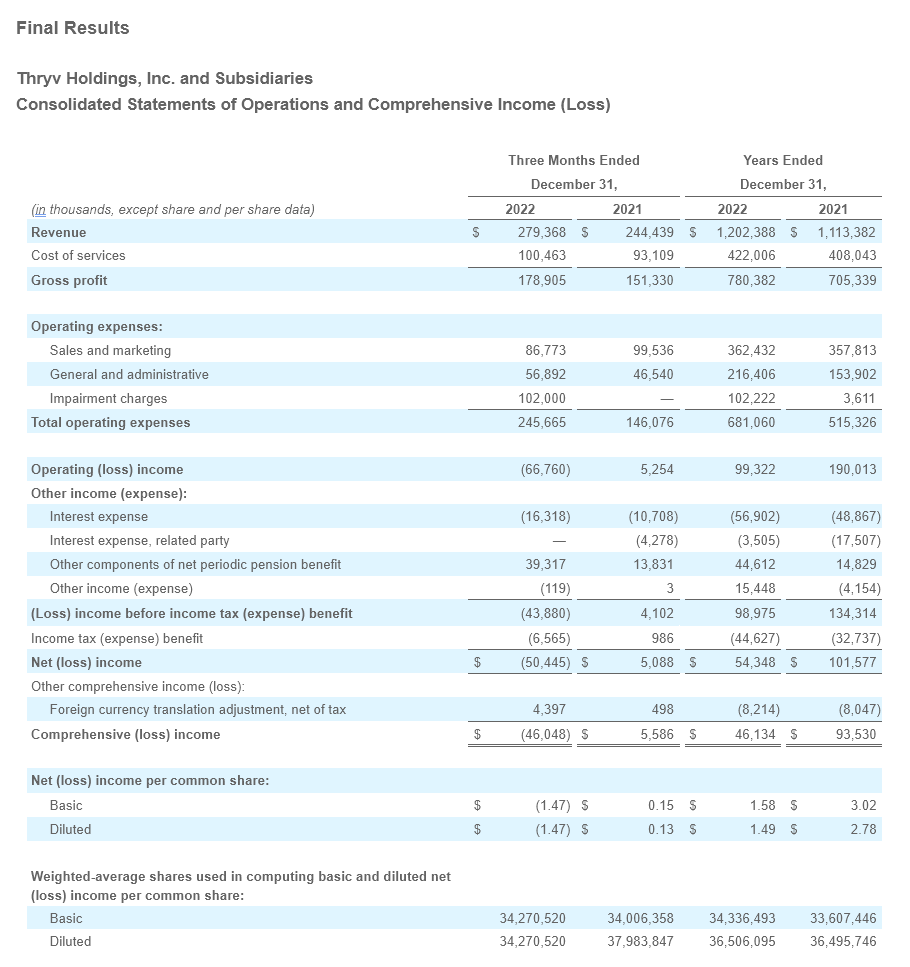

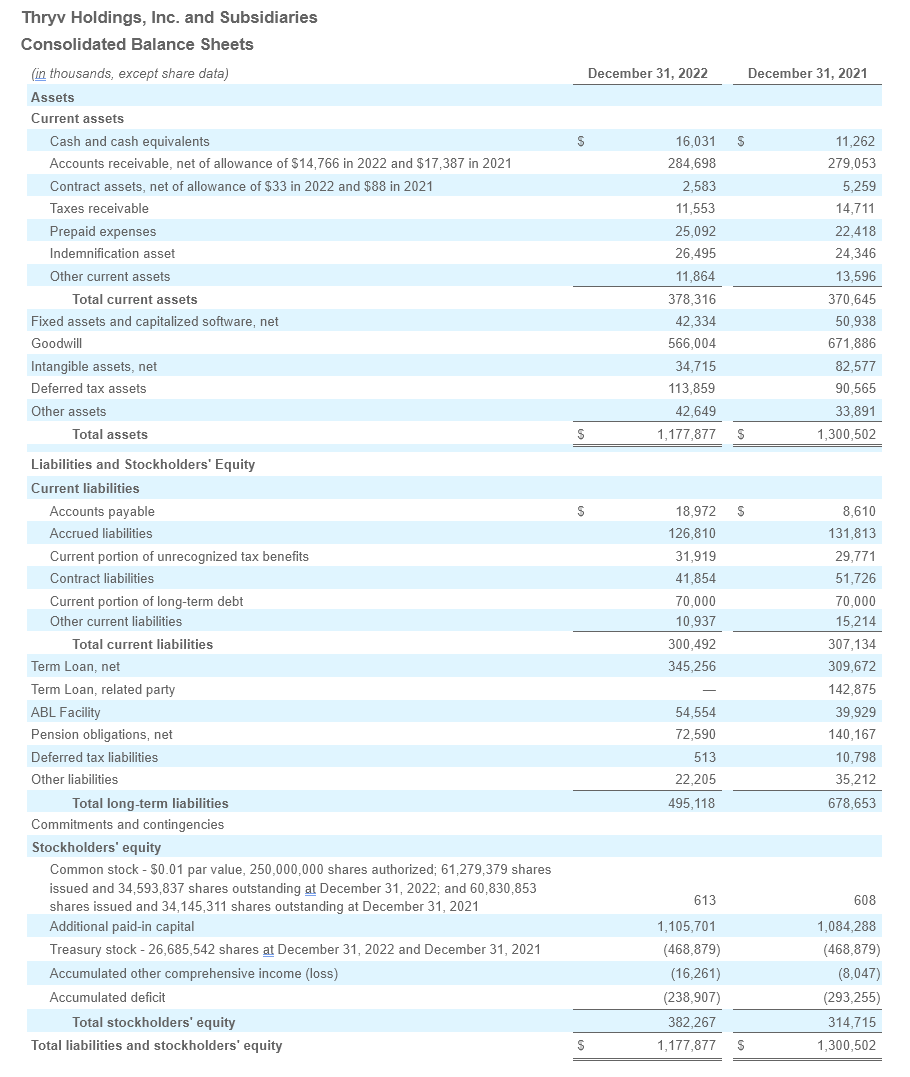

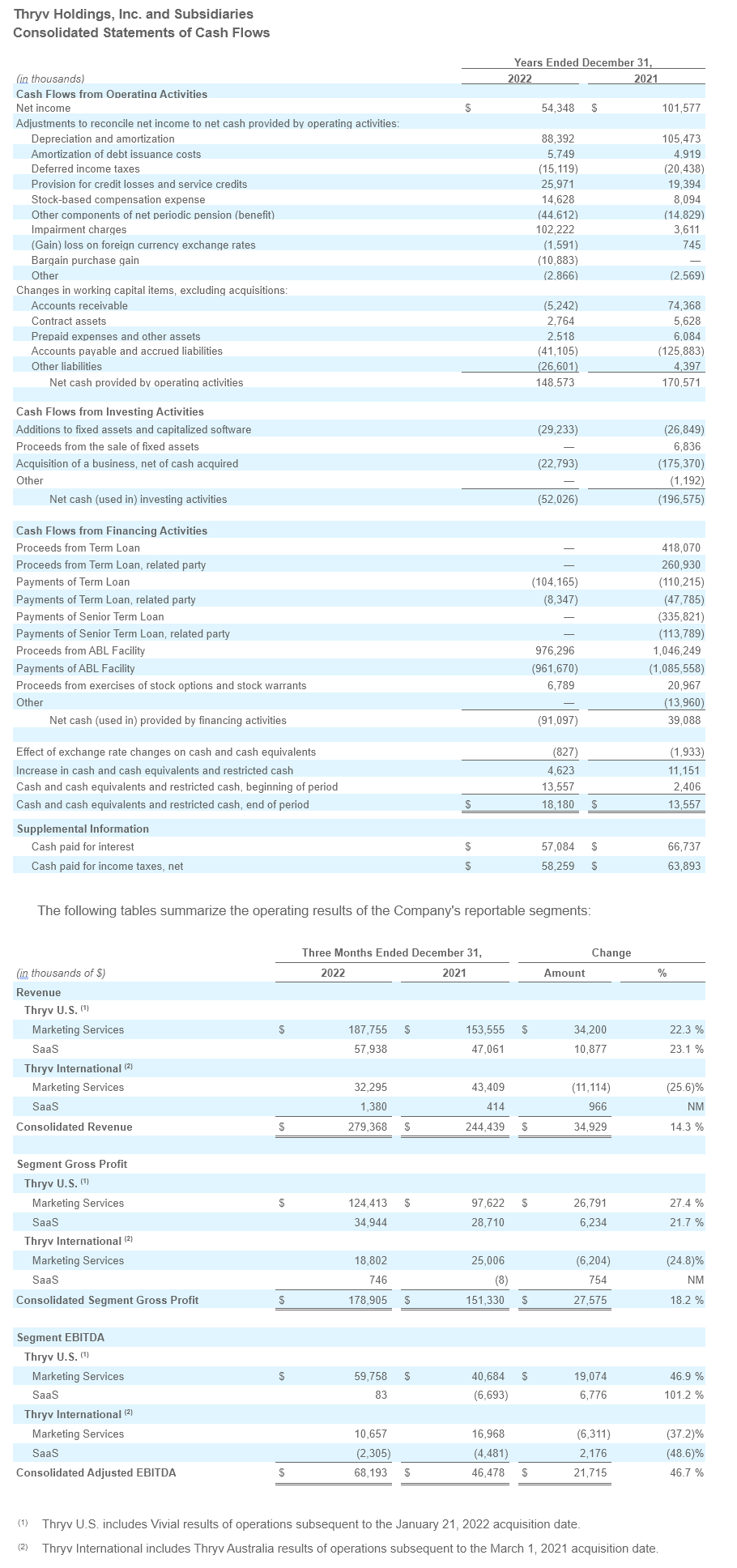

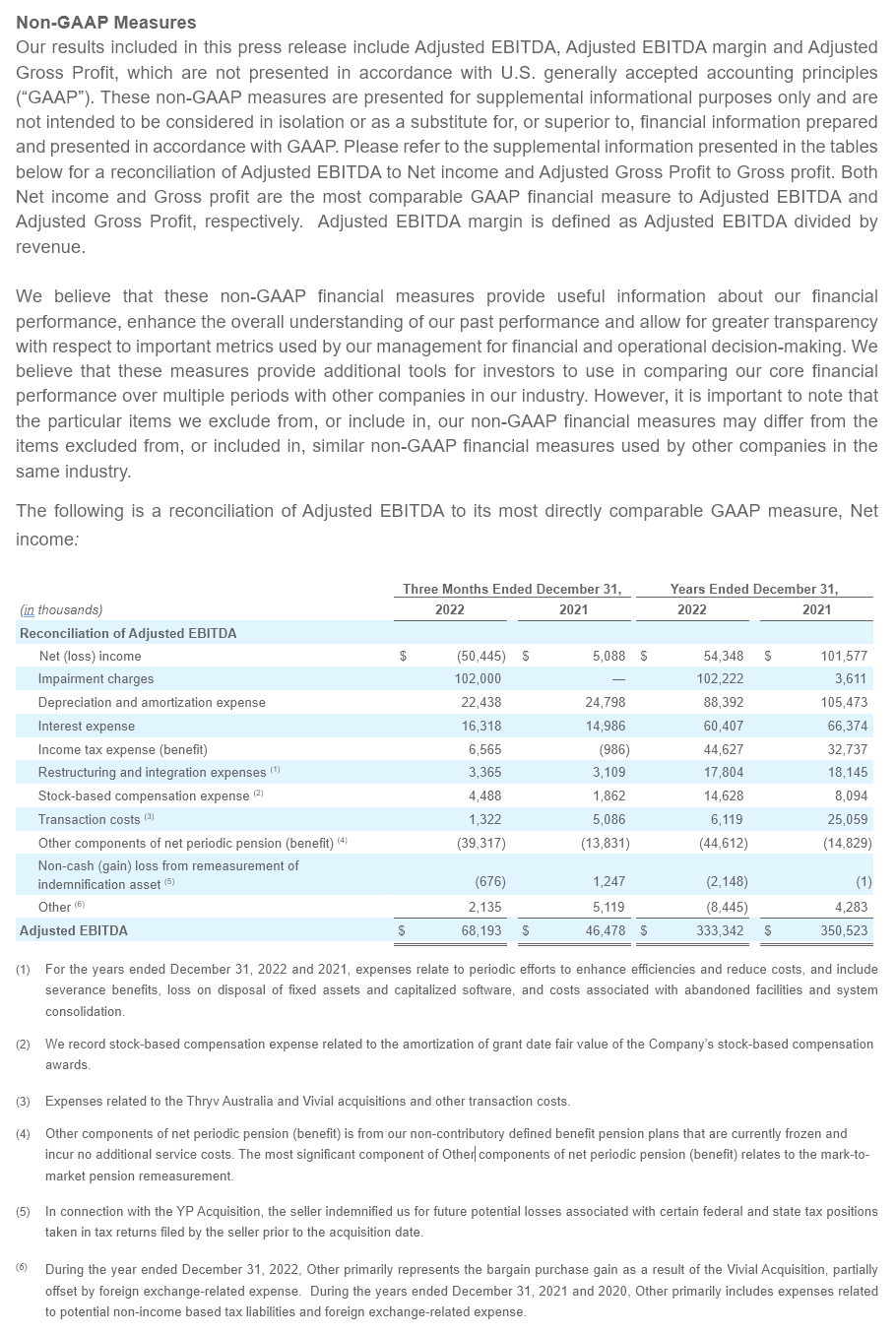

Fourth Quarter 2022 Financial Highlights:

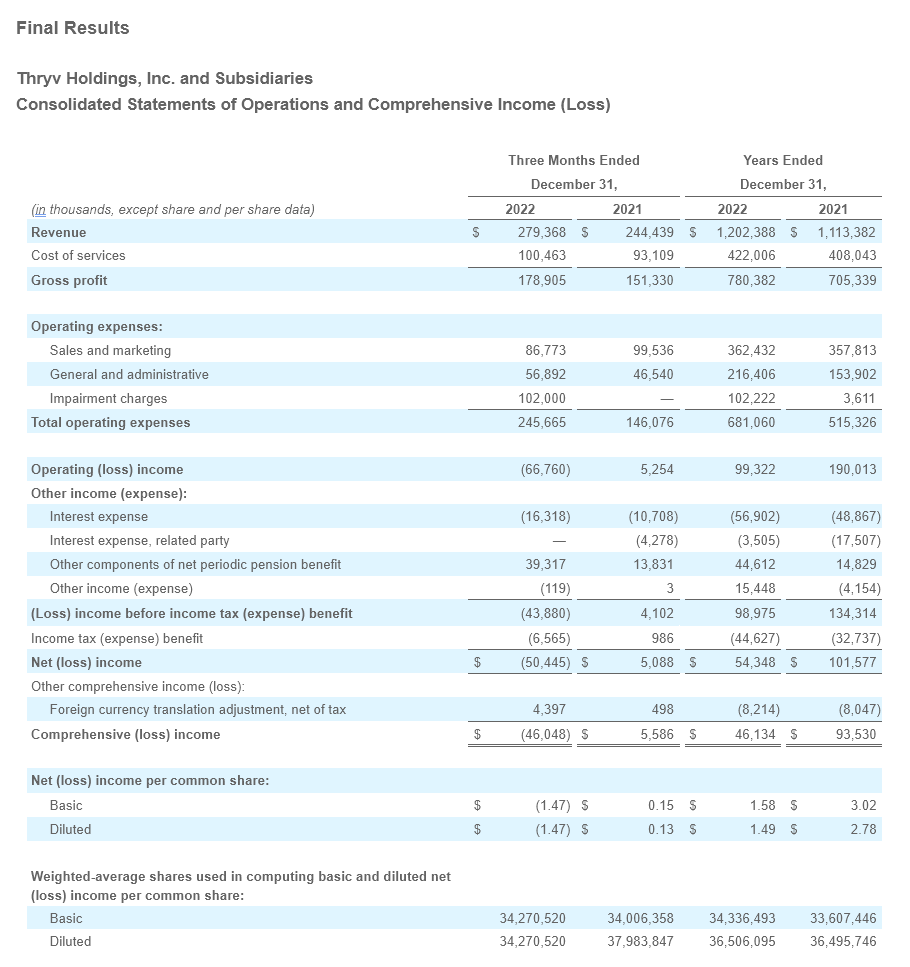

Revenue

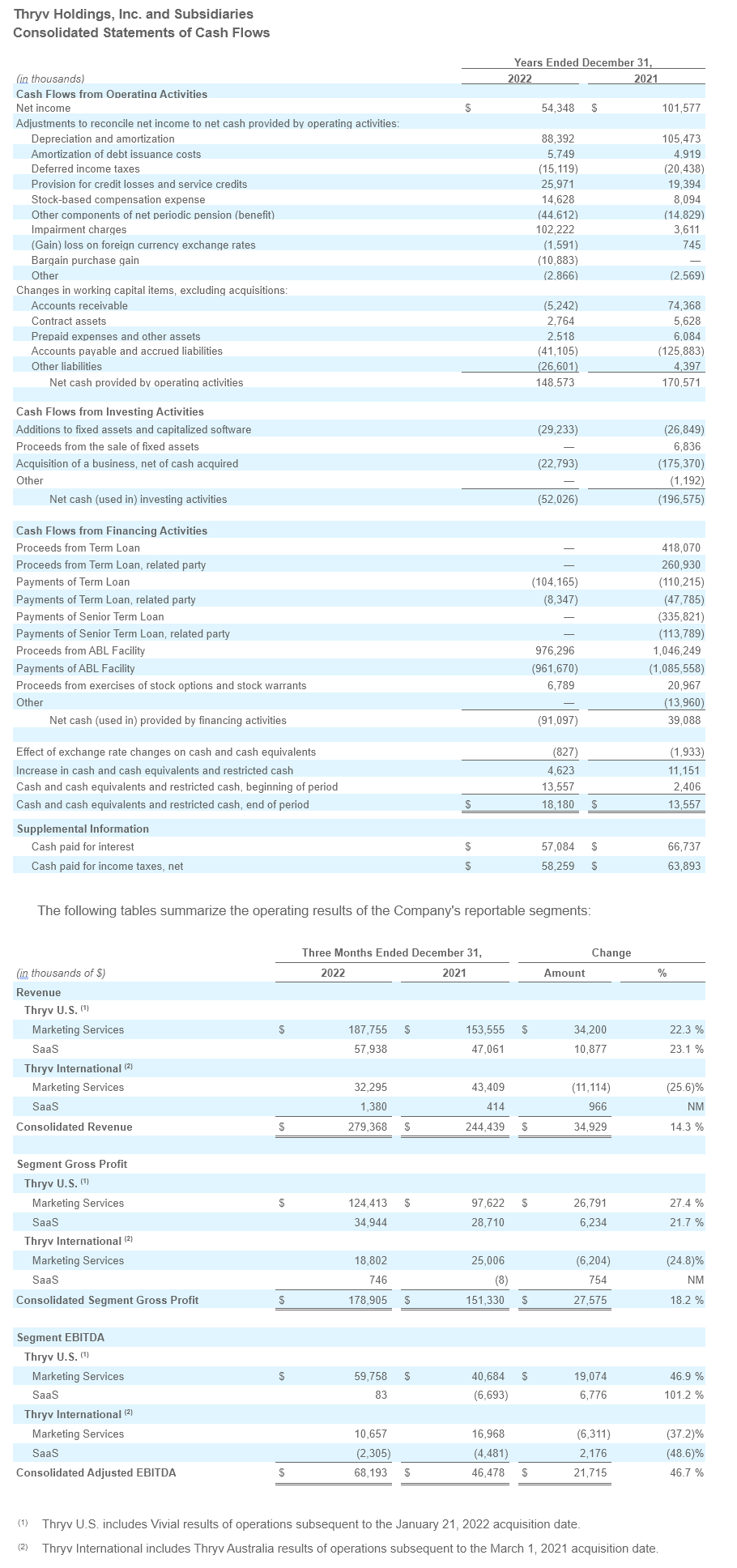

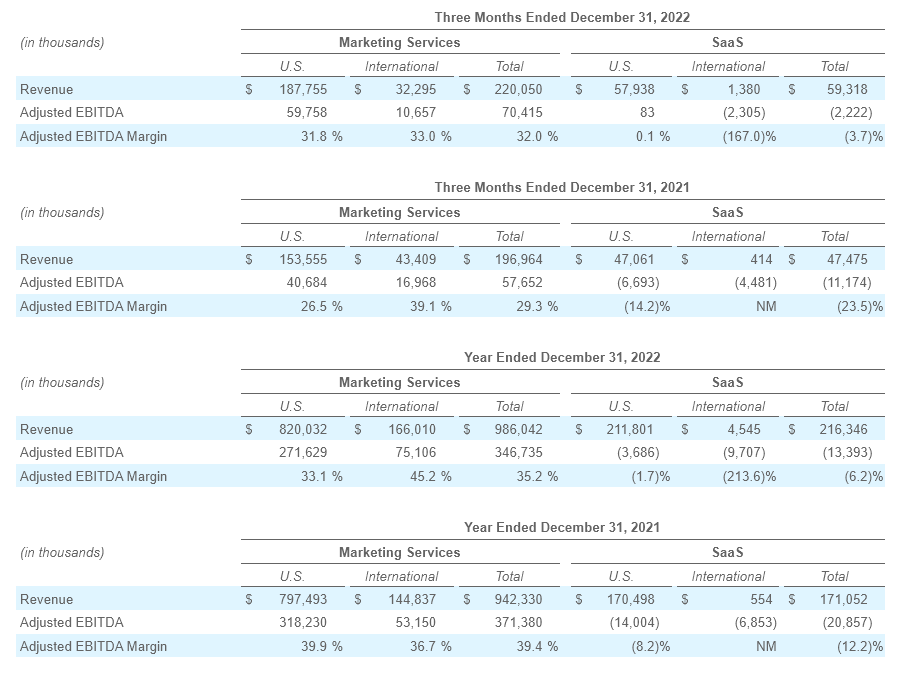

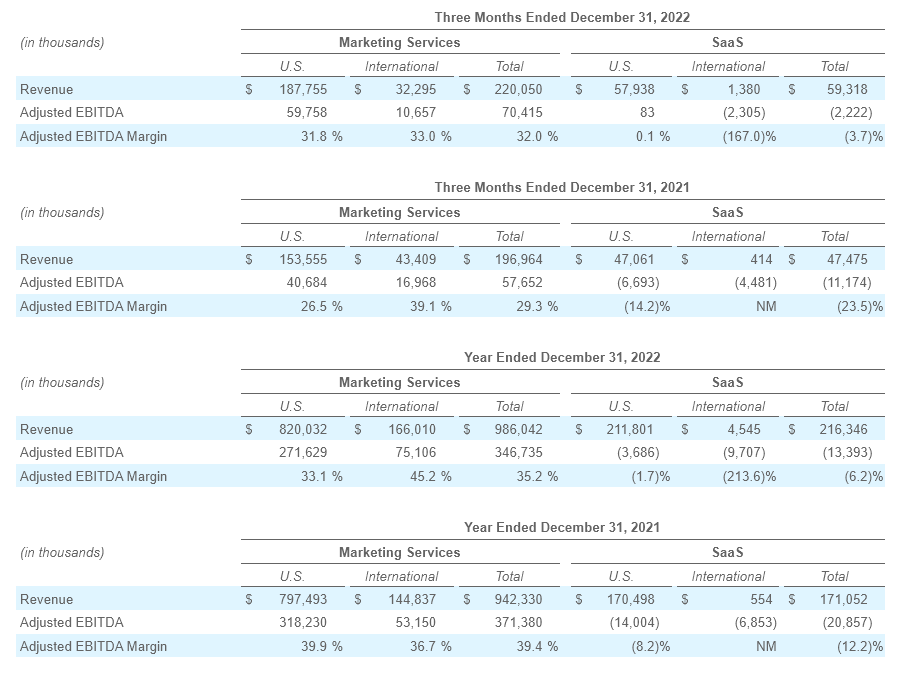

- Total SaaS1 revenue was $59.3 million, a 24.9% increase year-over-year

- Total Marketing Services2 revenue was $220.1 million, an 11.7% increase year-over-year

- Consolidated total revenue was $279.4 million, an increase of 14.3% year-over-year

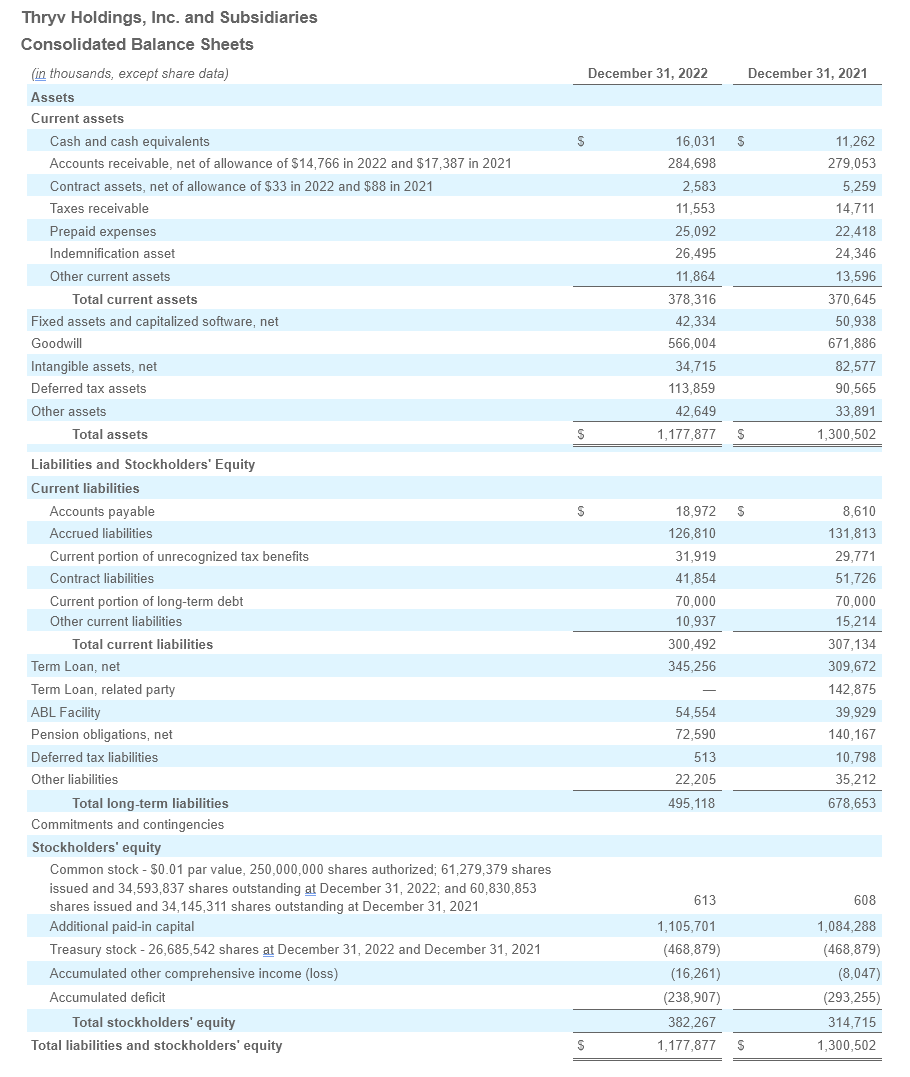

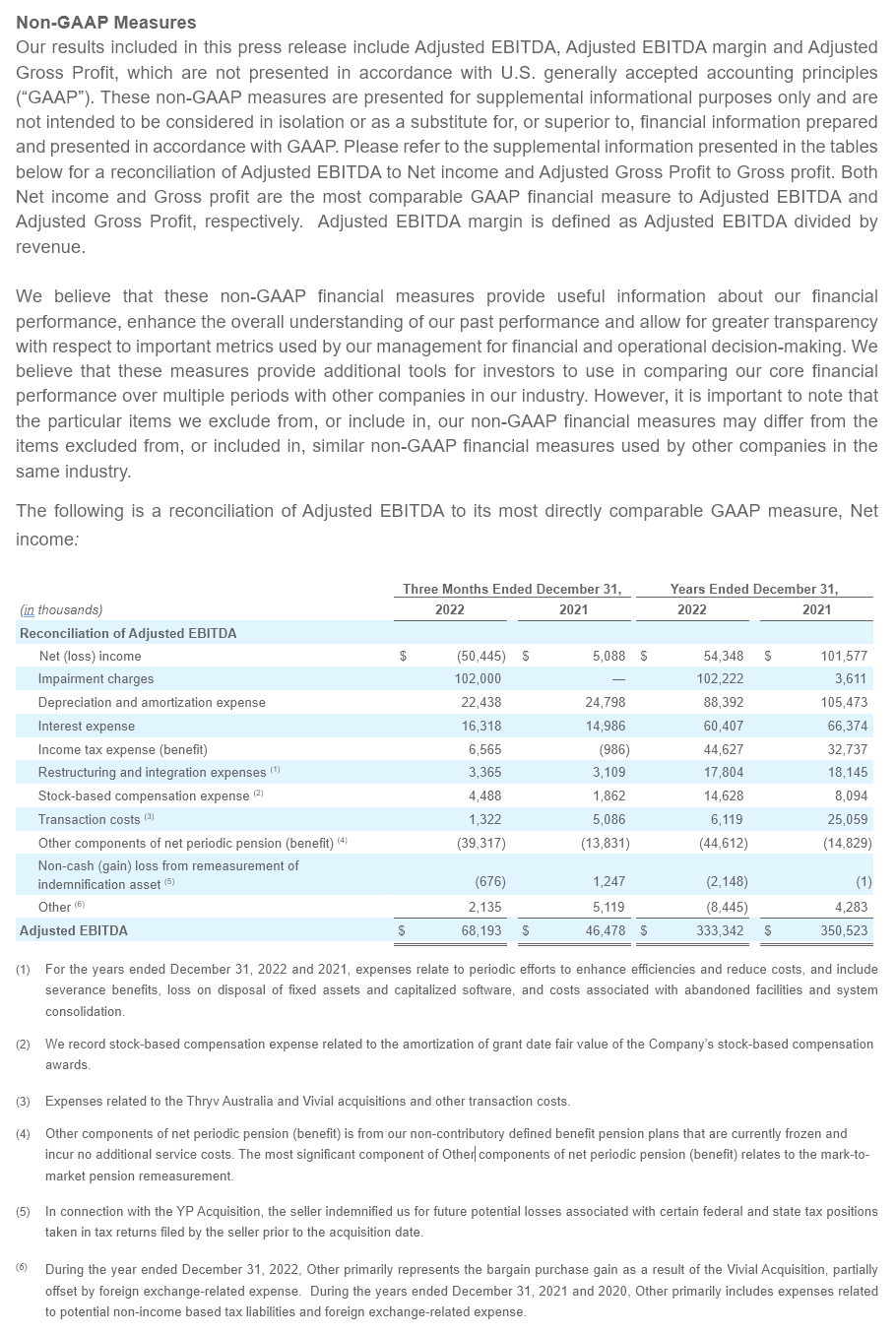

- Consolidated net loss was $50.4 million, or $(1.47) per diluted share, which includes a non-cash charge of $102.0 million, or $2.98 per diluted share, related to goodwill impairment; compared to net income of $5.1 million, or $0.13 per diluted share, for the fourth quarter of 2021

- Consolidated Adjusted EBITDA was $68.2 million, representing an Adjusted EBITDA margin of 24.4%

- Total SaaS Adjusted EBITDA loss was $2.2 million

- Total Marketing Services Adjusted EBITDA was $70.4 million, representing an Adjusted EBITDA margin of 32.0%

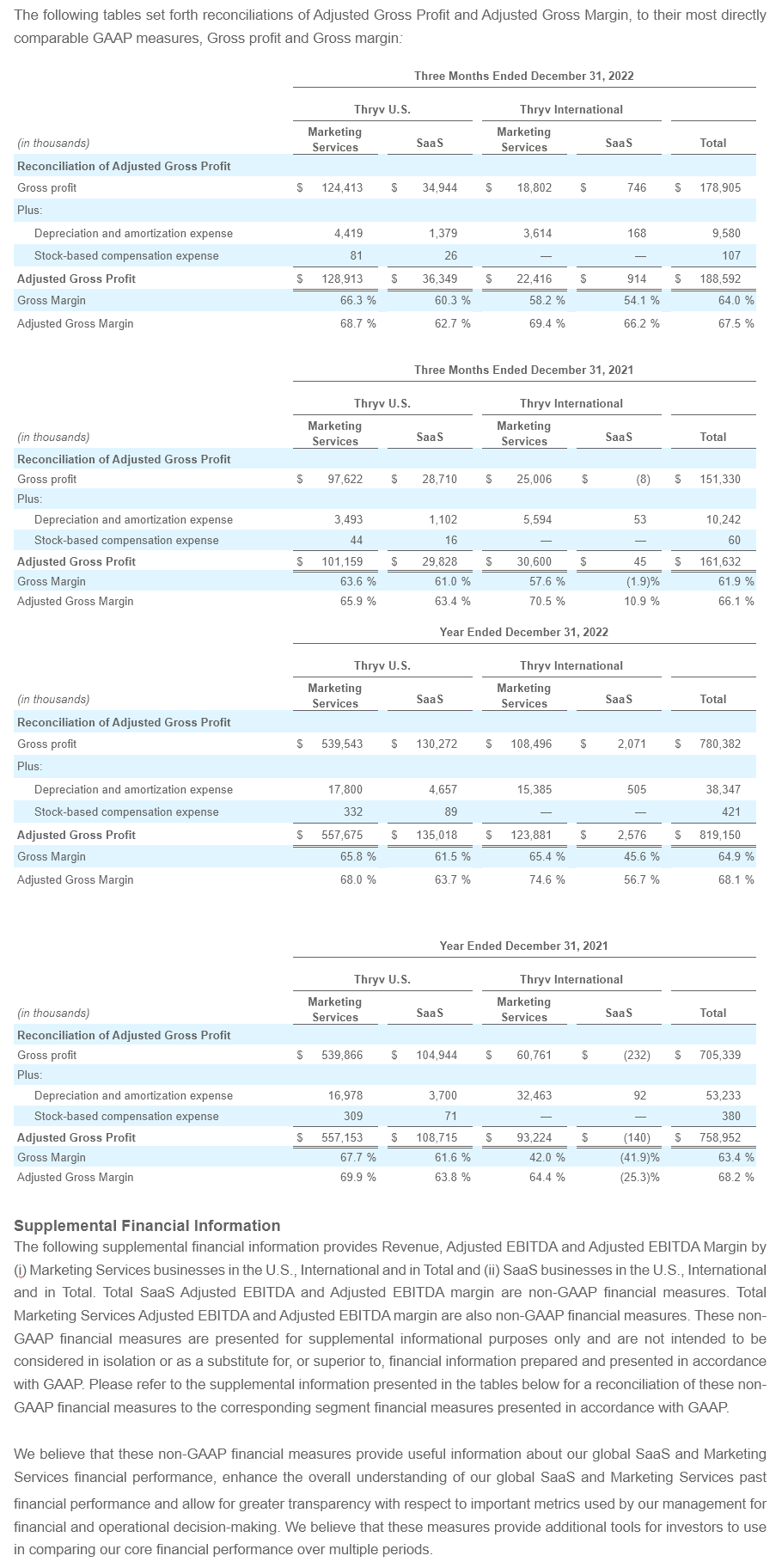

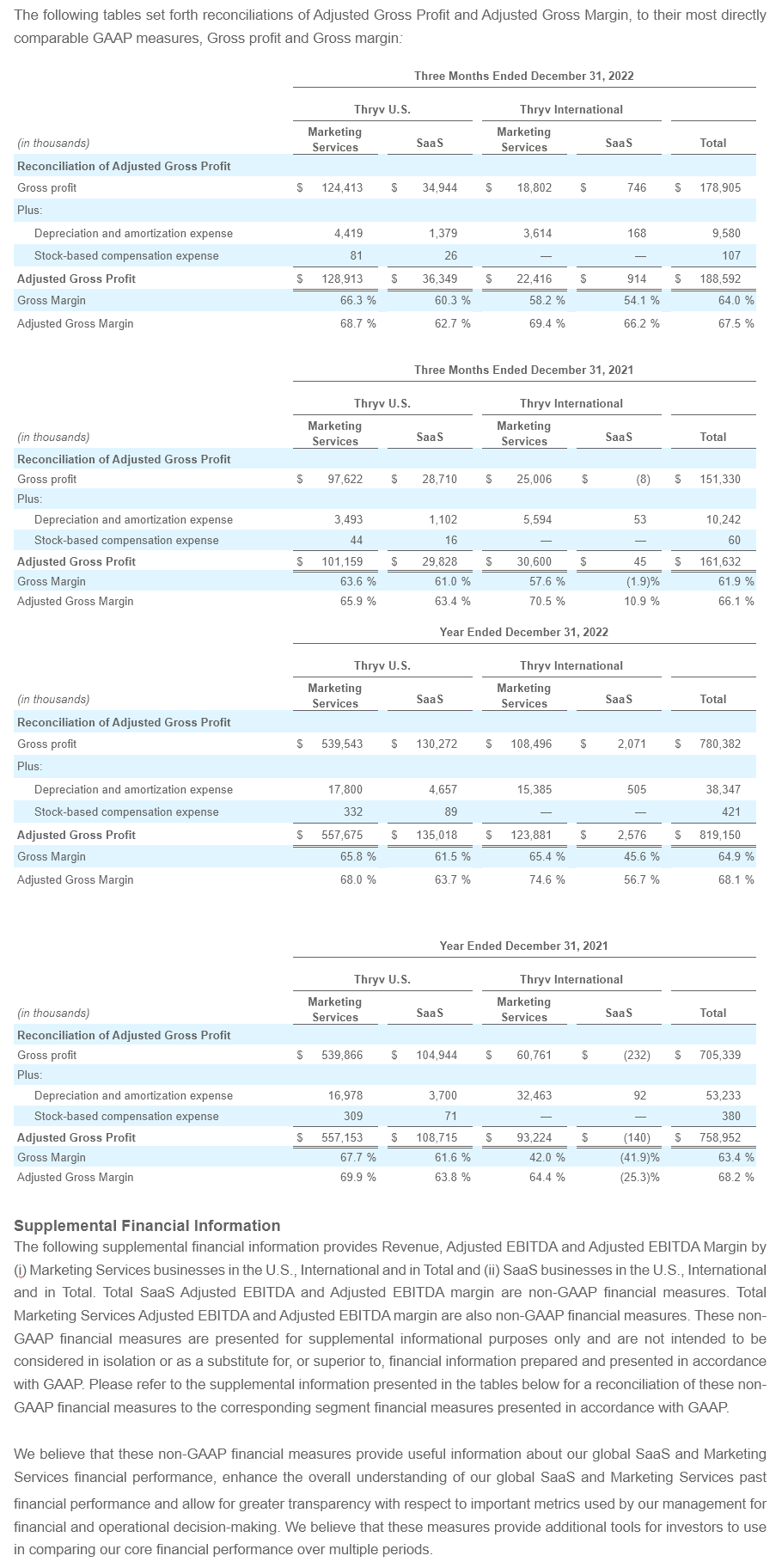

- Consolidated Gross Profit was $178.9 million, an increase of 18.2% year-over-year

- Consolidated Adjusted Gross Profit was $188.6 million

- SaaS Gross Profit was $35.7 million, representing a Gross Profit Margin of 60.2%

- SaaS Adjusted Gross Profit was $37.3 million, representing an Adjusted Gross Profit Margin of 62.8%

Full-Year 2022 Financial Highlights

- Total SaaS revenue was $216.3 million, a 26.5% increase year-over-year

- Total Marketing Services revenue was $986.0 million, an 4.6% increase year-over-year

- Consolidated total revenue was $1,202.4 million, an increase of 8.0% year-over-year

- Consolidated net income was $54.3 million, or $1.49 per diluted share, which includes a non-cash charge of $102.0 million related to goodwill impairment; compared to net income of $101.6 million, or $2.78 per diluted share, for the same period last year

- Consolidated Adjusted EBITDA was $333.3 million, representing an Adjusted EBITDA margin of 27.7%

- Total SaaS Adjusted EBITDA loss was $13.4 million

- Total Marketing Services Adjusted EBITDA was $346.7 million, representing an Adjusted EBITDA margin of 35.2%

- Consolidated Gross Profit was $780.4 million, an increase of 11% year-over-year

- Consolidated Adjusted Gross Profit was $819.2 million

- SaaS Gross Profit was $132.3 million, representing a Gross Profit Margin of 61.2%

- SaaS Adjusted Gross Profit was $137.6 million, representing an Adjusted Gross Profit Margin of 63.6%

SaaS Metrics

- SaaS monthly Average Revenue per Unit (“ARPU”)3 increased to $387 for the fourth quarter of 2022, compared to $351 in the fourth quarter of 2021

- Total SaaS clients increased 13% year-over-year to 52 thousand for the fourth quarter of 2022

- Seasoned Net Dollar Retention4 was 91% at the end of the fourth quarter of 2022

- SaaS monthly active users5 increased 37% year-over-year to 41 thousand active users for the fourth quarter of 2022

- ThryvPay total payment volume increased 114% year-over-year

1Total SaaS revenue in the U.S. and International segments was $57.9 million and $1.4 million for the three months ended December 31, 2022, respectively.

2Total Marketing Services revenue in the U.S. and International segments was $187.8 million and $32.3 million for the three months ended December 31, 2022, respectively.

Earnings Conference Call Information

Thryv will host a conference call on Thursday, February 23, 2023 at 8:30 a.m. (Eastern Time) to discuss the Company’s fourth quarter 2022 results.

For analysts to register for this conference call, please use this link. To listen to the webcast, please use this link or visit Thryv’s Investor Relations website at investor.thryv.com. After registering, a confirmation email will be sent, including dial-in details and a unique code for entry. We recommend registering a day in advance or at a minimum thirty minutes prior to the start of the call. A live webcast will also be available on the Investor Relations section of the Company’s website at investor.thryv.com.

If you are unable to participate in the conference call, a replay will be available. To access the replay, please dial (800) 770-2030 or (647) 362-9199 and enter “87769.”

3Defined as total client billings by month divided by the number of clients that have revenue-generating solutions during the month.

4Seasoned Net Dollar Retention is defined as net dollar retention excluding clients acquired over the previous 12 months.

5Defined as a client with one or more users who log into our SaaS solutions at least once during the calendar month.

6These statements are forward-looking and actual results may materially differ. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause our actual results to materially differ from these forward-looking statements.

Forward-Looking Statements

Certain statements contained herein are not historical facts, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. Statements that include the words “may”, “will”, “could”, “should”, “would”, “believe”, “anticipate”, “forecast”, “estimate”, “expect”, “preliminary”, “intend”, “plan”, “target”, “project”, “outlook”, “future”, “forward”, “guidance” and similar statements of a future or forward-looking nature identify forward-looking statements. These statements are not guarantees of future performance. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: risks related to the ongoing COVID-19 pandemic, the Company’s ability to maintain adequate liquidity to fund operations; the Company’s future operating and financial performance; the Company’s ability to consummate acquisitions, or, if consummated, to successfully integrate acquired businesses into the Company’s operations, the Company’s ability to recognize the benefits of acquisitions, or the failure of an acquired company to achieve its plans and objectives; limitations on our operating and strategic flexibility and the ability to operate our business, finance our capital needs or expand business strategies under the terms of our credit facilities; our ability to retain existing business and obtain and retain new business; general economic or business conditions affecting the markets we serve; declining use of print yellow page directories by consumers; our ability to collect trade receivables from clients to whom we extend credit; credit risk associated with our reliance on small and medium sized businesses as clients; our ability to attract and retain key managers; increased competition in our markets; our ability to obtain future financing due to changes in the lending markets or our financial position; our ability to maintain agreements with major Internet search and local media companies; reduced advertising spending and increased contract cancellations by our clients, which causes reduced revenue; and our ability to anticipate or respond effectively to changes in technology and consumer preferences as well as the risks and uncertainties set forth in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on From 10-Q filed with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. For these reasons, we caution you against relying on forward-looking statements. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. These forward-looking statements speak only as of the date hereof and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

About Thryv Holdings, Inc.

Thryv Holdings, Inc. (NASDAQ: THRY) is a global software and marketing services company that empowers small- to medium-sized businesses (“SMBs”) to grow and modernize their operations so they can compete and win in today’s economy. Over 50,000 businesses use our award-winning SaaS platform, Thryv®, to manage their end-to-end operations, which has helped businesses across the U.S. and overseas grow their bottom line. Thryv also manages digital and print presence for approximately 390,000 businesses, connecting these SMBs to local consumers via proprietary local search portals and print directories. For more information about Thryv Holdings, Inc, visit thryv.com.

Media Contact:

Paige Blankenship

Thryv, Inc.

214-392-9609

[email protected]

Investor Contact:

Cameron Lessard

Thryv, Inc.

214.773.7022

[email protected]