DALLAS, February 22, 2021 – Thryv Holdings, Inc. (NASDAQ:THRY), the provider of Thryv® software, the end-to-end client experience platform for growing small businesses, announced preliminary, unaudited results for the fourth quarter and fiscal year 2020, exceeding previously issued guidance for the same period.

“We are pleased with our performance in what was a challenging year for so many companies. Thryv’s SaaS business is growing, and the numbers reflect that,” said Joe Walsh, CEO of Thryv. “It is energizing to start this new year in a position of strength, and as we move through 2021, we will look to capitalize on the momentum we are seeing. As we look forward to 2021 and future years, we believe we are well positioned as a category leader in SaaS.”

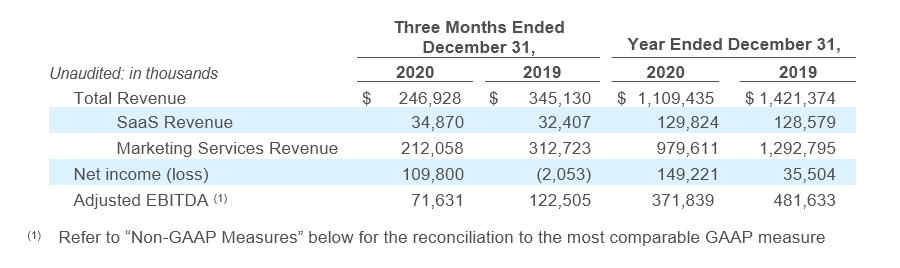

Preliminary Fourth Quarter 2020 Financial Highlights:

- SaaS revenue was $34.9 million, an 8% increase year-over-year. Our guidance was $33 million

- Marketing Services revenue was $212.1 million. Our guidance range was $190-$200 million

- Total revenue was $246.9 million. Our guidance range was $223-$233 million

- Net income was $109.8 million

- Adjusted EBITDA was $71.6 million. Our guidance range was $58-$63 million

Preliminary Fiscal Year 2020 Financial Highlights:

- SaaS revenue was $129.8 million. Our guidance was $128 million

- Marketing Services revenue was $979.6 million. Our guidance range was $955-$965 million

- Total revenue was $1,109.4 million. Our guidance range was $1,083-$1,093 million

- Net income was $149.2 million

- Adjusted EBITDA was $371.8 million. Our guidance range was $358-$363 million

Additional Preliminary Business Highlights:

- SaaS ARPU increased to $293 in the fourth quarter, up from $260 in the third quarter of 2020

- Total SaaS clients ending the fourth quarter of 2020 was 44.0 thousand, flat when compared to the third quarter of 2020

- SaaS monthly churn improved to 2.4% in the fourth quarter, down from 2.7% in the third quarter of 2020

- Leverage Ratio was 1.3x in the fourth quarter, as defined in the Thryv, Inc. credit agreement

- Total Debt repayment was $186.1 million for fiscal year 2020. Term loan and ABL ending balances for the fourth quarter of 2020 were $449.6 million and $79.2 million, respectively

We have provided preliminary unaudited estimated results. These unaudited results reflect management’s estimates based solely upon information available to it as of the date of this release and are not a comprehensive statement of our financial results. As a result, there is a possibility that our final audited results which will be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (our “Annual Report”) will vary from these preliminary estimates.

Outlook:

Based on information available as of February 22, 2021, Thryv Holdings is issuing guidance for fiscal year 2021 as indicated below.

- SaaS revenue between $139 – $143 million

- Marketing Services revenue between $740 – $760 million

These statements are forward-looking and actual results may materially differ. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause our actual results to materially differ from these forward-looking statements.

Earnings Conference Call Information

Thryv will announce the date of its fourth quarter and fiscal year 2020 earnings conference call in an upcoming release.

Preliminary Unaudited Results

The following is preliminary unaudited information for the three months and year ended December 31, 2020. Audited information for the three months and year ended December 31, 2019 is included for comparability (in thousands):

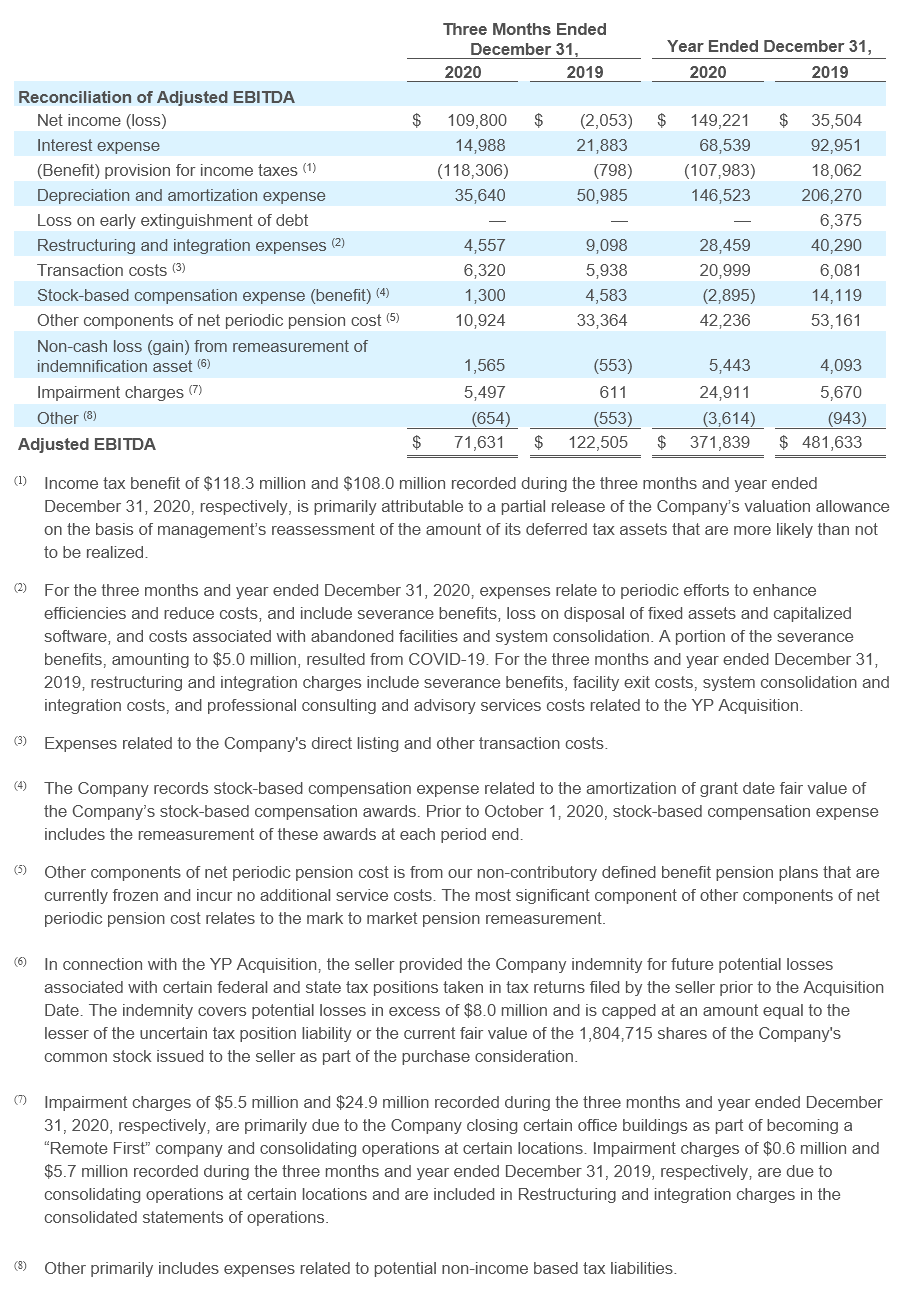

Non-GAAP Measures

Our preliminary results included in this press release include Adjusted EBITDA, which is not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). This non-GAAP measure is presented for supplemental informational purposes only and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the table below for a reconciliation of Adjusted EBITDA to net income, the most comparable GAAP financial measure.

We believe that this non-GAAP financial measure provide useful information about our financial performance, enhances the overall understanding of our past performance and future prospects and allows for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that this measure provides an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, it is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry.

The following is a reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, net income (in thousands):

About Thryv Holdings, Inc.

The company owns the easy-to-use Thryv® end-to-end customer experience software built for growing small businesses that helps over 40,000 SaaS clients with the daily demands of running a business. With Thryv, they can get the job, manage the job and get credit. Thryv’s award-winning platform provides modernized business functions, allowing small-to-medium-sized businesses (SMB) to reach more customers, stay organized, get paid faster and generate reviews. These functions include building a digital customer database, automated marketing through email and text, updating business listings across the internet, scheduling online appointments, sending notifications and reminders, managing ratings and reviews, generating estimates and invoices and processing payments.

Thryv supports franchise operators and multi-location business owners with Hub by Thryv™, a software console that enables businesses managers to oversee their operations using the Thryv software.

Thryv also connects local businesses to consumer services through our search, display and social media management products, our print directories featuring The Real Yellow Pages® tagline, and our local search portals, which operate under the DexKnows.com®, Superpages.com® and Yellowpages.com URLs and reach some 35 million monthly visitors. For more information about the company, visit thryv.com.

Thryv delivers business services to more than 360,000 SMBs across America that enable them to compete and win in today’s economy.

Learn more about Thryv on LinkedIn and Medium.

Forward-Looking Statements

Some statements included in this release constitute forward-looking statements. Statements that include the words “may”, “will”, “could”, “should”, “would”, “believe”, “anticipate”, “forecast”, “estimate”, “expect”, “preliminary”, “intend”, “plan”, “project”, “outlook”, “future”, “forward”, “guidance” and similar statements of a future or forward-looking nature identify forward-looking statements. These statements are not guarantees of future performance. Forward-looking statements provide current expectations with respect to our financial performance and future events with respect to our business and industry in general. Forward-looking statements are based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: risks related to the ongoing COVID-19 pandemic, the Company’s ability to maintain adequate liquidity to fund operations; the Company’s future operating and financial performance; limitations on our operating and strategic flexibility and the ability to operate our business, finance our capital needs or expand business strategies under the terms of our credit facilities; our ability to retain existing business and obtain and retain new business; general economic or business conditions affecting the markets we serve; declining use of print yellow page directories by consumers; our ability to collect trade receivables from clients to whom we extend credit; credit risk associated with our reliance on small and medium sized businesses as clients; our ability to attract and retain key managers; increased competition in our markets; our ability to obtain future financing due to changes in the lending markets or our financial position; our ability to maintain agreements with major Internet search and local media companies; reduced advertising spending and increased contract cancellations by our clients, which causes reduced revenue; and our ability to anticipate or respond effectively to changes in technology and consumer preferences. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. For these reasons, we caution you against relying on forward-looking statements. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. These forward-looking statements speak only as of the date hereof and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Media Contact:

Paige Blankenship

Thryv, Inc.

972.453.3012

[email protected]

Investor Contacts:

Cameron Lessard

Thryv, Inc.

214.773.7022

[email protected]

KJ Christopher

Thryv, Inc.

972.453.7068

[email protected]